What is the IRS 1040 Tax Table?

The booklet contains Tax and Earned Income Credit Tables from the Instructions for Form 1040 (and 1040-SR). The booklet's sole purpose is to help taxpayers calculate the taxes they owe; it does not contain the 1040 form itself.

Additionally, this document contains a Tax Computation Worksheet that you can use for your calculations online.

Who needs 1040 Tax Tables 2024?

The US Internal Revenue Service has prepared a 1040 Tax Table to assist individual taxpayers in figuring out the amount of federal tax due that must be reported on Form 1040 and its supplemental forms.

Understanding how to use the tables will make it easier for any individual to calculate the tax they owe or provide them with an estimate of future tax bills if they need to budget for them.

Is this worksheet a self-sustained document?

The IRS 1040 Tax Table is not the only piece of information to refer to when filing an individual tax return. We recommend you carefully read all the instructions before filing. Please locate and explore the current instructions here.

How long are tax tables accurate for?

To help individuals during tax-filing season, the Internal Revenue Service updates tax tables each year in the federal return instructions and in IRS Publication 17. That’s why we highly recommend that taxpayers filing in 2025, check the Form 1040 Instructions for the latest information.

How do federal Tax Tables help?

Understanding how to use the tax tables will make it easier to calculate your income tax. Follow our 4-steps instructions below to do it in minutes:

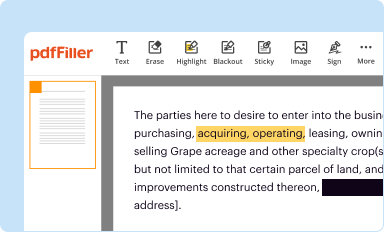

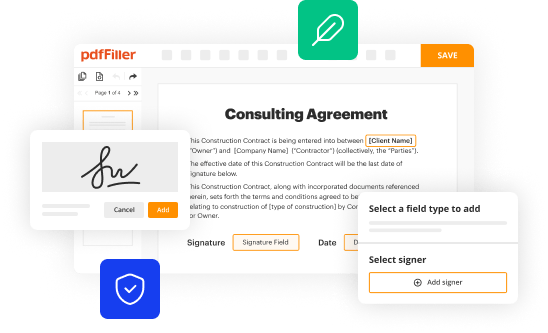

- Click Get Form at the top of this page to open the document in your browser.

- Determine your income brackets in the left-hand column of the table.

- Identify your filing status in the top row of the worksheet.

- Identify the amount located where the row with your income and the column for your filing status intersect.

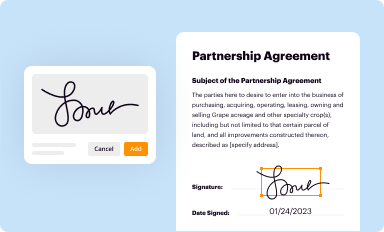

That’s how easy it is to calculate your income taxes online. You can download this printable PDF booklet to your computer for your reference or save it to your pdfFiller account and have instant access from any device whenver you need it.